- Get link

- X

- Other Apps

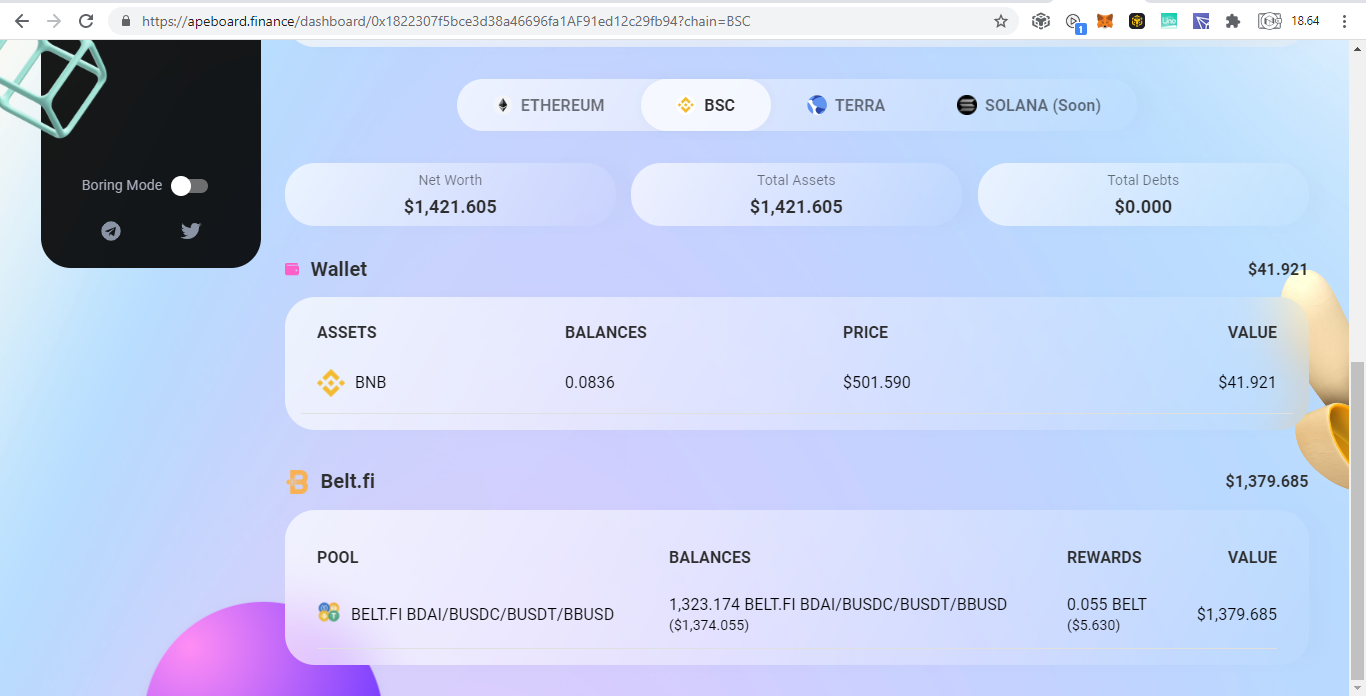

Ape Board Finance

Yield Watch

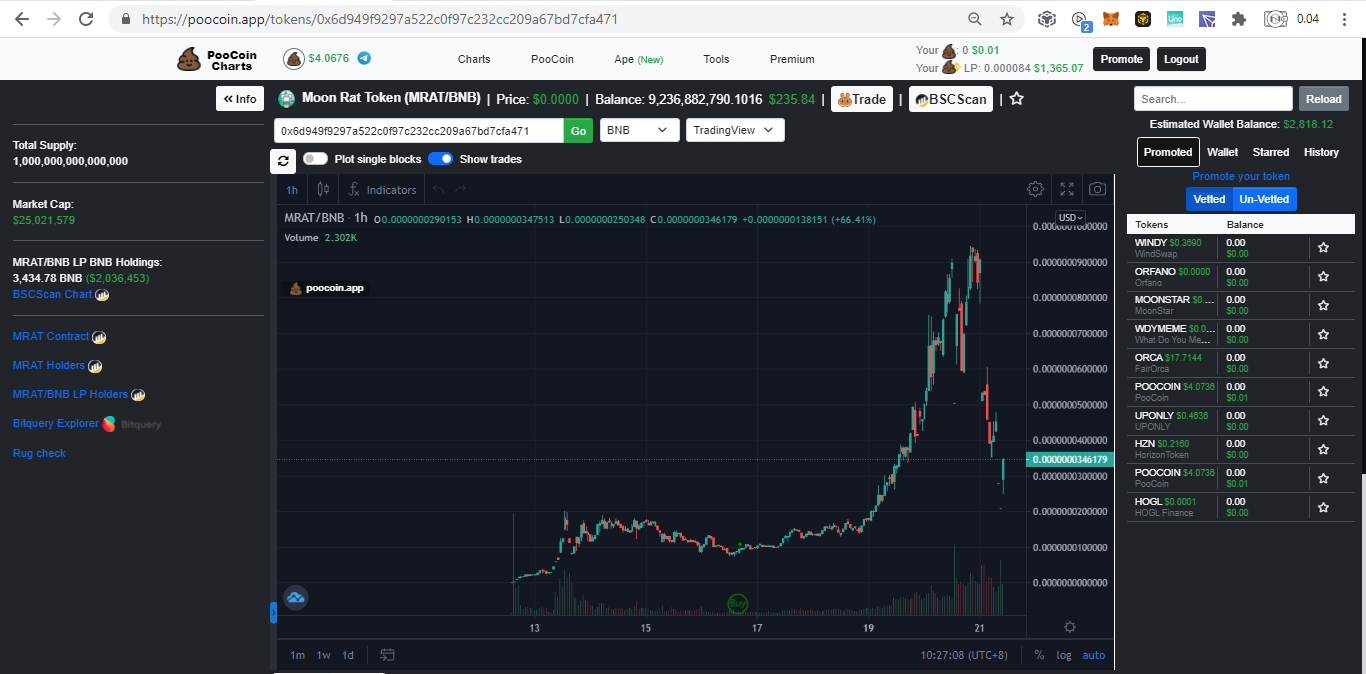

Poo Coin

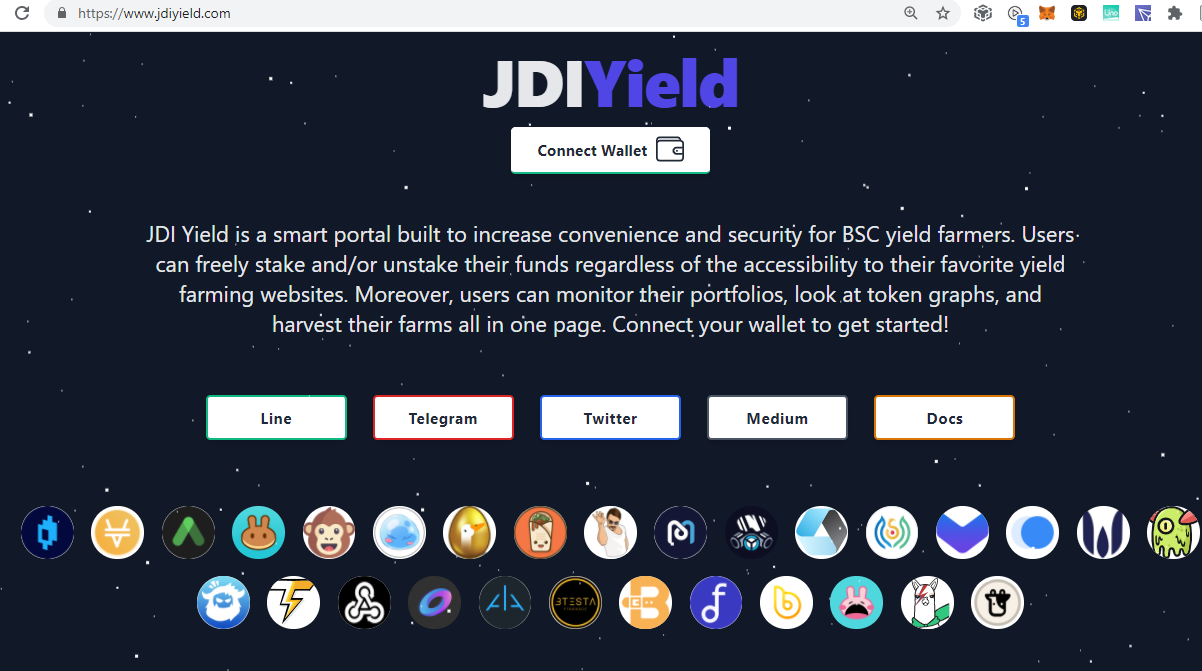

JDI Yield

If you know anymore, please leave them in the comment section.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/binance-smart-chain-and-yield-farming-portfolio-tools-early-xqkjklk?a=4oeEw0Yb0B&tid=blogger

- https://0darkking0.blogspot.com/2021/04/binance-smart-chain-and-yield-farming.html

- https://0fajarpurnama0.medium.com/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021-6a24af61b9b8

- https://0fajarpurnama0.github.io/cryptocurrency/2021/04/21/bsc-yield-farming-portfolio-tools-early-2021

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/bsc-yield-farming-portfolio-tools-early-2021

- https://steemit.com/cryptocurrency/@fajar.purnama/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021?r=fajar.purnama

- https://leofinance.io/@fajar.purnama/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021?ref=fajar.purnama

- https://blurtter.com/cryptocurrency/@fajar.purnama/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021?referral=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021

- http://0fajarpurnama0.weebly.com/blog/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/227-binance-smart-chain-and-yield-farming-portfolio-tools-early-2021

- https://read.cash/@FajarPurnama/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021-b2a58d1c

- https://www.uptrennd.com/post-detail/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021~ODg4MDQ2

- https://trybe.one/binance-smart-chain-and-yield-farming-portfolio-tools-early-2021

- https://www.floyx.com/article/0fajarpurnama0/binance-smart-chain-and-yield-farming-portfolio-to-0001cf608a

- https://markethive.com/0fajarpurnama0/blog/binancesmartchainandyieldfarmingportfoliotoolsearly2021

- Get link

- X

- Other Apps

Comments

Pancake is also interesting because you can earn by listing new tokens. There is a listingspy.net project that helps with this. I don’t know why the author didn’t mention this))

ReplyDeleteYou can select interesting tokens, analyze, and immediately sort out the scam. You can add this platform to the article)